What Infosys and HDFC Bank Results Don't Tell You

MP: Who would you want to meet for lunch?

WB: It would be Isaac Newton.

This conversation once took place between Warren Buffett and his protege Mohnish Pabrai.

In June 2007, Pabrai had made headlines by bidding with Guy Spier for a charity lunch with Buffett. So, he wondered who Buffett would love to have lunch with. And Buffett's reply stumped him.

The desire to meet the 17th century mathematician and physicist was not out of Buffett's desire for quantitative insights on stocks from the genius. Rather Buffett wondered how even someone like Newton could go wrong.

Brilliant scientists have been known to do foolish things. But Isaac Newton's financially disastrous moves during the South Sea Bubble of 1720 are a particularly remarkable blunder. Despite Newton's expertise in finance, groupthink led him to plunge into the South Sea Bubble and lose much of his fortune.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

----------------------------------------

It seems Newton had invested early and liquidated his stake in the company early. But as the stock kept rising, Newton gave in to his greed and bought the stock again. Only to lose much of his fortune.

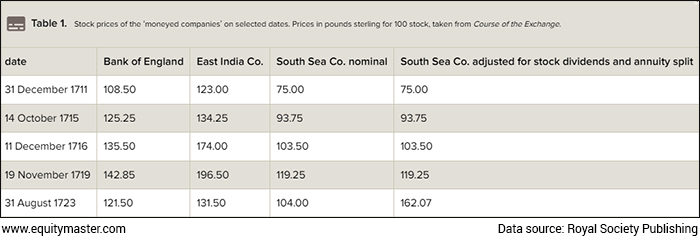

But the fact is that both the rise and the crash in the stock were temporary. Data suggests that had Newton avoided selling or buying the stock for few more years, he would have bagged a decent profit.

Stock Prices of 17th Century Bluechips in England

Now, why dwell on 300-year-old market crashes? Especially when we have sufficient cases of steep price corrections in stocks close at hand?

Well, Buffett's curiosity and Newton's folly is the repetitive nature of fear and greed cycles.

So, lets consider the recent market apathy towards Infosys.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Choose Your Pick

Unnecessarily Risky Small Caps vs Small Caps Brimming with Opportunity

Discover the Small Cap Strategy Thousands of Equitymaster Subscribers Use

I'm interested

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

Through 2022, most Indian tech companies began warning of slowing growth and loss of clients. But Infosys continued to impress analysts on earnings calls by talking up its revenue pipelines. To analysts' delight, the company kept raising its growth forecasts for the year.In January 2023, the company reported signing a US$ 3.3 bn contract value. So, it raised its full-year revenue growth guidance for the third time. Naturally, the stock price kept soaring in anticipation of lofty near-term earnings growth.When the company prepared to disclose its full-year results in April, market expectations were high. Unfortunately, the inevitable occurred.

Infosys failed to meet its own guidance, despite a reasonable earnings growth at 15.4% for the year. Analysts tracking quarterly numbers were disappointed. And the stock was taken to the cleaners.

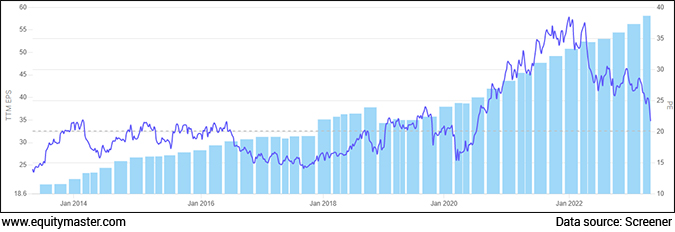

What the results did not say was that such earnings volatility has been a part of Infosys' track record for decades.

And the sharp correction in the PE multiples have been a great opportunity to accumulate the stock. But only if investors have a long-term perspective.

Infosys' P/E versus Trailing 12-month EPS Over the Decade

Similar is the case with HDFC Bank.

Lofty expectations about the merger with HDFC allowed the stock premium valuations for months. But a delay in the merger proceedings disappointed markets.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

India's Lithium Megatrend is an Emerging Opportunity for Investors

We all know how oil producing countries made fortunes in the last century.

But now, the world is moving away from oil... and closer to Lithium.

Lithium is the new oil. That's the reason why India is focusing heavily on expanding its lithium reserves.

If you can tap into this opportunity, then there is a potential to make huge gains over the long term.

See Details Here

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

Moreover, stiff competition from fintech peers has also got markets nervous about HDFC Bank's future.

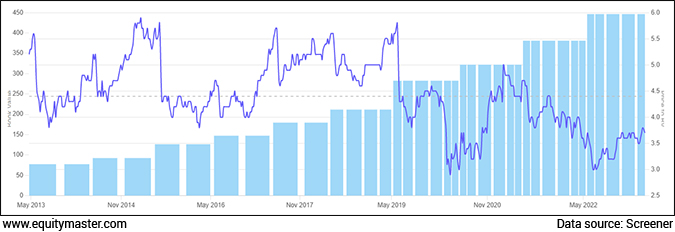

What the bank's results do not tell you is how its consistency in keeping NPAs in check works wonders for the stock.

HDFC Bank's Price to Book versus Book Value Over the Decade

Now, if I were to hazard a guess on what Newton would tell Buffett at the lunch table, it would be this...

- It's not mathematical genius but disciplined buying and selling that works wonders.

Warm regards,

Tanushree Banerjee

Editor, StockSelect

Equitymaster Agora Research Private Limited (Research Analyst)

Recent Articles

- Is this Famous Tata Stock a Hidden Trap for Investors? April 29, 2024

- A case study on why this Tata Stock might be overheated.

- Multibagger Stocks for the Next 10 Years April 28, 2024

- What are the potentially top 10 multibagger stocks for the long term? Find out...

- This Transformer Stock is About to Hit Rs 10,000. Is it Still Value for Money? April 27, 2024

- To scale up renewable energy generation in India, this company is looking to open more centres in India.

- Stocks Profiting from the Rise of the Luxury Class in India April 26, 2024

- These stocks benefit the most from the growing opulent class in India.

Equitymaster requests your view! Post a comment on "What Infosys and HDFC Bank Results Don't Tell You". Click here!

3 Responses to "What Infosys and HDFC Bank Results Don't Tell You"

SANKARAN VENKATARAMAN

Apr 25, 2023You have not recommended BUY for Infosys /HDFC Bank though the prices of both stocks are reasonable and companies are investment worthy from all parameters